Now is the Time to Expand Your Business Fleet by Shopping with Bill Colwell Ford

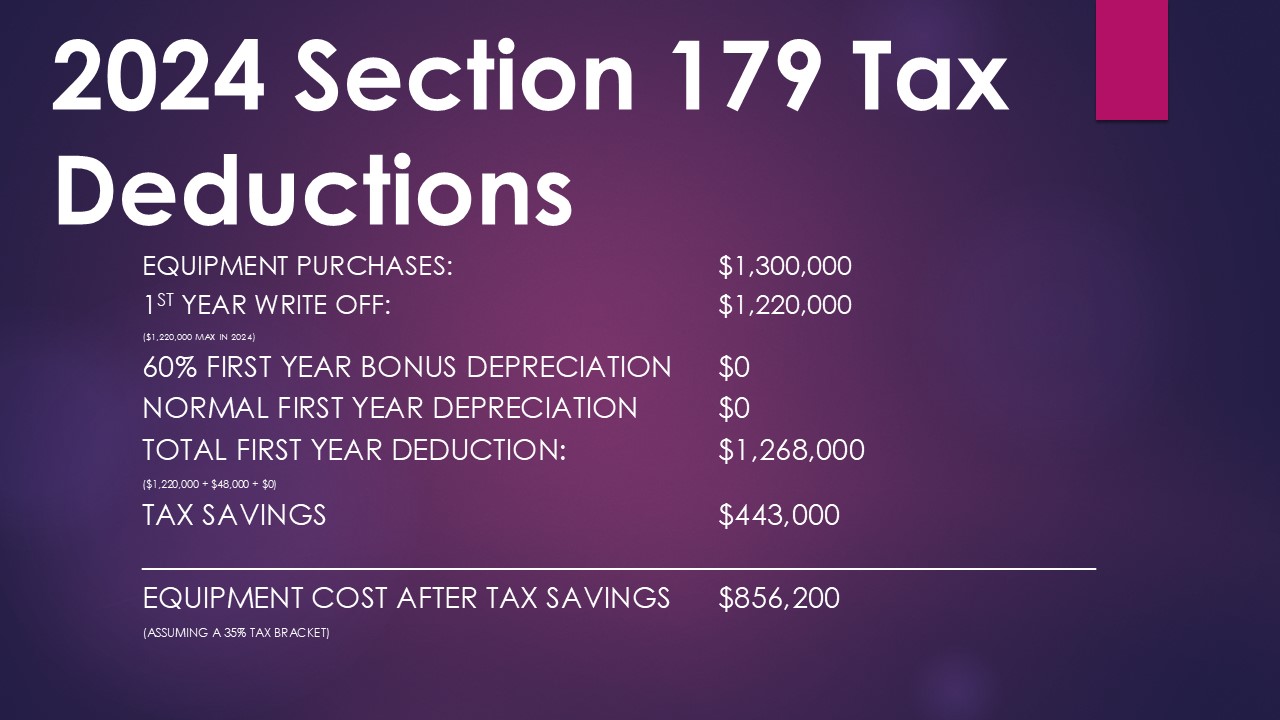

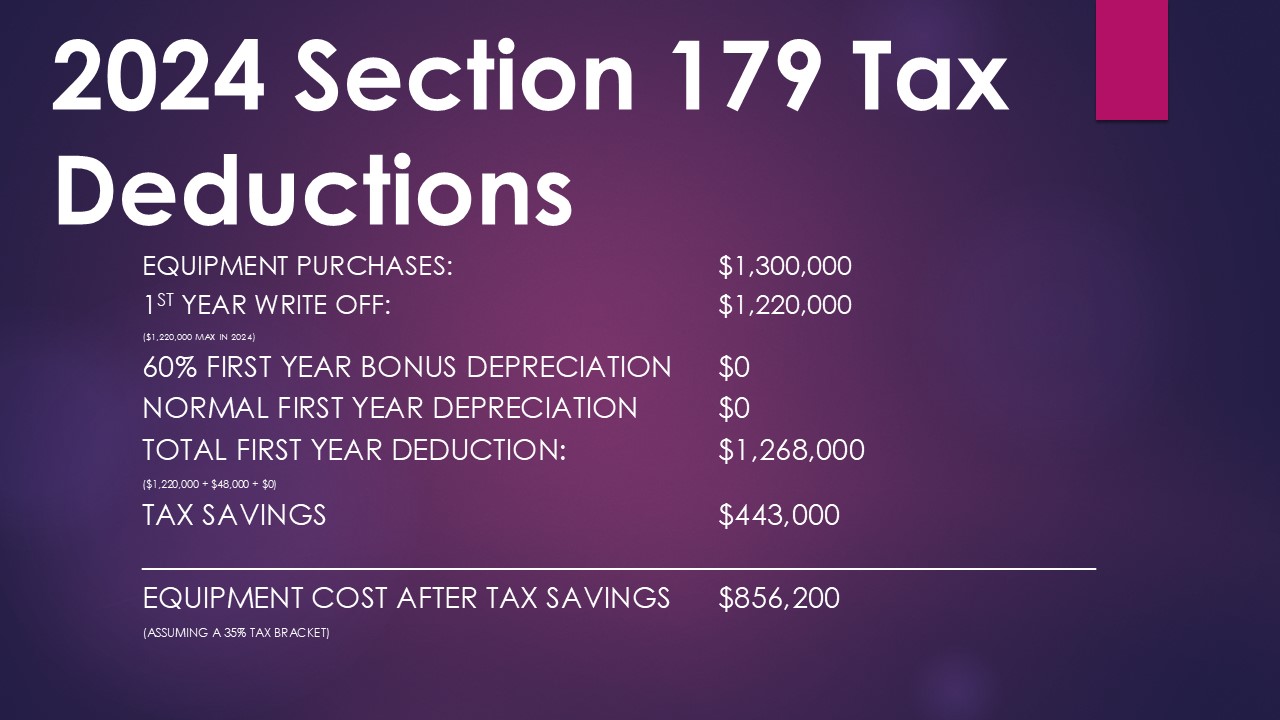

Whether you have a fleet of one or dozens in Hudson, IA, buying new equipment now can save you on this year's taxes. Under Section 179 of the IRS tax code, businesses that buy and use new equipment before the end of the year can write off up to 100 percent of the purchase price of the equipment. There are three qualifying categories for vehicles that businesses can write off. It is best to consult with your tax advisor before buying a new vehicle on the assumption that it qualifies under Section 179.

Ford Vehicles with a Gross Vehicle Weight Rating Greater Than 6,000 Pounds

The First category under Section 179 is eligible for up to 100 percent of the vehicle purchase price being taken as a deductible on your 2024 taxes. This includes nearly every vehicle Ford produces that is sold as a commercial vehicle in Cedar Falls. The Ford Super Duty pickups, any Transit van with seating for more than ten, and long-bed F-150 pickups.

Other Ford Vehicles with a GVWR Greater Than 6,000 Pounds

Under Section 179, vehicles in this category are eligible for up to $30,500 in deductions, up to 60 percent of the purchase price, and a standard depreciation deduction. Vehicles available in Waterloo included in this category are the F-150 with a short bed, the Ford Expedition, and the Ford Explorer.

Ford Vehicles with a GVWR Less Than 6,000 Pounds

This category is eligible for up to $20,400 in tax deductions. The Ford Transit Connect would fall into this category, along with a few others.

Contact Bill Colwell Ford

Contact Bill Colwell Ford

If you want to take advantage of Section 179 tax savings in Cedar Rapids, now is the time. Bill Colwell Ford has a great inventory of vehicles that qualify. Our Sales Representatives will work with you to answer any questions. We recommend asking your tax professional if you would like further information on Section 179. Contact us today to schedule a test drive.